Flight Insurtech: Leveraging Flight Data API for Smarter Aviation Insurance

Da

Flight Insurtech is changing aviation insurance. It uses real-time and past flight data. This helps automate claims, set better prices, and enhance customer experience.

DataWorks offers global flight data APIs for more than 1,200 airlines and 10,000 airports. This helps insurers create smart, data-driven insurance solutions. These solutions can lower operational costs and improve service efficiency.

Flight Risks Are Frequent and Measurable

Flight-related risks are high-frequency and measurable:

- In 2024, the average flight delay in Europe was 17.5 minutes. Only about 72% of flights arrived within 15 minutes of their scheduled time. Roughly one in four flights experienced a delay of over 15 minutes.

- Total delay minutes across Europe reached 30.4 million minutes, an increase of 114% compared to 2015, far exceeding the 6.7% growth in total flights.

- Airlines delayed about 218,000 flights in Europe for over 3 hours or canceled them. This is 1.5% of all outbound flights.

These statistics show that flight delays and cancellations are common. They are now a regular risk we can expect. Without high-coverage, high-quality flight data, insurers cannot accurately price products or automate claims efficiently.

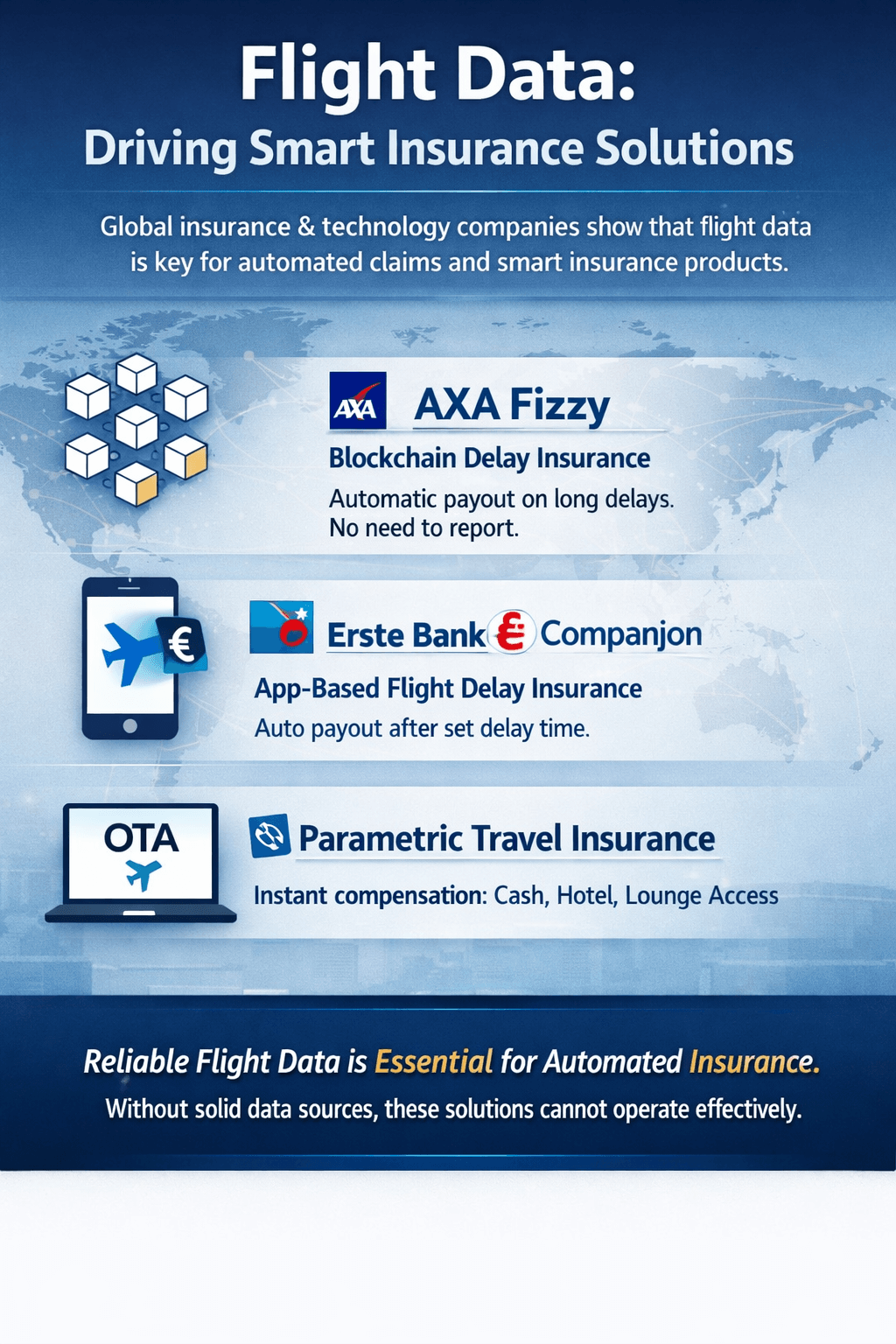

Market Applications of Flight Data in Insurance

Global insurance and technology companies show that flight data is key for automated claims and smart insurance products.

- AXA Fizzy is a flight delay insurance that uses blockchain. A flight delay that lasts too long automatically triggers claims. Customers do not need to report the delay.

- Erste Bank and Companjon offer flight delay insurance in a mobile banking app. If your flight delays for a certain time, you will receive automatic payouts.

- OTA booking processes include Parametric Travel Insurance. If a flight delays, the airline automatically provides compensation. This can be cash, hotel vouchers, or lounge access.

These examples highlight that reliable flight data is essential for automated claims and parametric insurance products. Without a stable data source, such solutions cannot operate effectively.

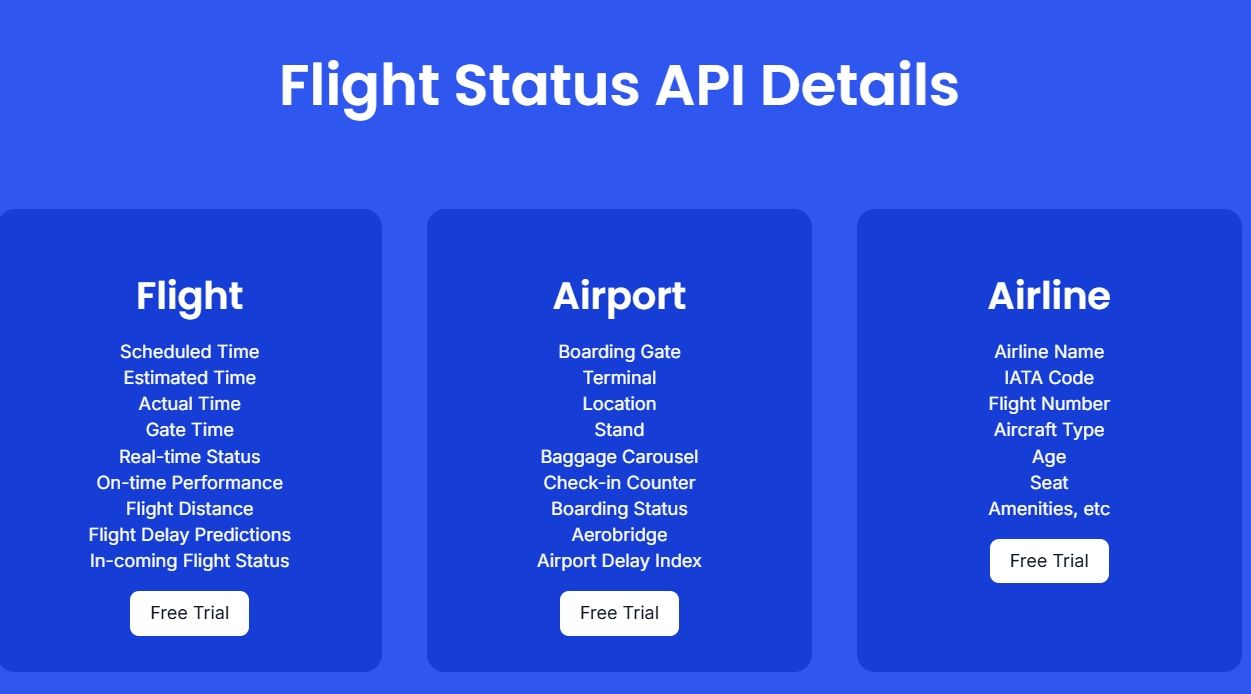

DataWorks Flight Data Capabilities

DataWorks provides comprehensive flight data support for aviation insurers through:

- We cover over 1,200 airlines and more than 10,000 airports. This includes about 97% of commercial flights worldwide. We also have nearly ten years of historical data for analyzing trends and modeling risks.

- Real-time and historical data work together. Real-time data helps with claims and supports services that change quickly. Historical data is important for predicting risks and setting prices.

- Easy API integration: Standardized flight data API with technical support to quickly connect with insurer systems.

- Free trial: 14-day data testing to verify quality and integration feasibility.

With these capabilities, insurers can:

- Build precise pricing models for flights and routes

- Implement automated claims and parametric insurance solutions

- Provide real-time insurance services and dynamic compensation for OTAs, TMCs, and banking apps

- Reduce operational costs, minimize manual checks, and improve customer satisfaction

Partners and Data Value

Partners: AirHelp, Companjon, Allianz, and others.

These partnerships and client implementations show that flight data is the foundation for underwriting, claims automation, and intelligent insurance. Insurers can leverage data for risk prediction, precise pricing, automated claims triggers, and enhanced customer experience.

Conclusion

The main challenge in aviation insurance is managing high-frequency, small-scale risks efficiently.

DataWorks flight data enables insurers to:

- Visualize risk: Combine real-time and historical data for precise risk analysis

- Optimize pricing strategies: Adjust premiums dynamically by route, airline, and time of travel

- Enhance claims efficiency: Automated claims triggers reduce manual intervention

- Lower operational costs: Minimize fraud risk and labor-intensive processes

- Improve customer experience: Real-time notifications, dynamic compensation, and embedded insurance simplify travel protection

Get 14-day free data trial Here

Flight delays and cancellations have become significant, high-frequency risks in aviation. Data-driven aviation insurance will become the industry standard by using flight data APIs. It offers smarter, more convenient, and reliable protection for passengers. At the same time, it creates lasting value for insurers.

Reference:

Eurocontrol – All Causes Delays Air Transport Europe Annual 2024

IATA – Press Release 2025-12-09

ITIJ – Skycop Reveals 2024 European Flight Disruption Figures

AVweb – European Air Traffic Delays Rise, High Cost

AgencyChecklists – AXA Smart Insurance Contract

Fintech Global – Erste Bank Flight Delay Insurance

AltexSoft – Parametric Insurance in Travel

DataWorks – Designing Smart Travel Insurance with Real-Time Delay Data

Kasko – Embedded Travel Insurance for Airlines

India Insurtech – Embedded Travel Protection