Flight Delay Verification: Boost Insurance Claims Efficiency

Da

Insurers can use historical flight data to automate delay verification, improve claims efficiency, reduce manual workload, and deliver transparent, explainable decisions that build customer trust and support regulatory compliance.

The Role of Flight Data in Insurance Processes

Pre-Claims: Risk Pricing and Cost Control

With reliable historical data, pricing and underwriting decisions are also easier to justify internally and externally, supporting governance and regulatory review. Insurers can change premiums or adjust underwriting strategies by predicting flight delay chances before they issue policies. This helps lower future payouts and manage risk.

Claims Stage: Automated Verification

During claims processing, reported delays are compared against verified flight data. Most systems can automatically validate claims, with only a small number requiring manual review. This approach significantly reduces manual workload and improves overall claims efficiency.

More importantly, automated and traceable verification allows insurers to clearly explain claim decisions to customers, reducing disputes and follow-up inquiries.

Each decision can be backed by consistent data sources and historical records, making outcomes both fast and defensible.

Post-Claims: Product Innovation Using Historical Data

Historical flight data can be analyzed to identify patterns across routes, airlines, and airports. Insurers can leverage these insights to design new products, optimize payout rules, and refine risk models. Flight data thus becomes a foundation for data-driven product development, not just a verification tool.

As parametric and instant-claim products scale, flight data evolves from a backend utility into a credibility layer—supporting not only automation, but also trust in how products behave in real-world scenarios.

Challenges Without Systematic Verification

Without automated verification, insurers must manually check each flight, often relying on airline websites or direct communications with airlines. This process takes a lot of time and effort. It often faces delays, which raises costs and slows down claims processing.

Common but suboptimal practices include:

❌ Manual checks of airline websites – fragmented and hard to scale

❌ Customer-submitted delay proofs – authenticity issues and poor user experience

❌ Single data source – incomplete coverage, requiring additional manual verification

These approaches cannot meet the demands of high-frequency, large-scale, and regulation-sensitive claims processing.

Manual processes also make it difficult to provide consistent explanations to customers or evidence during audits, increasing operational and compliance risk.

Core Verification Metrics

In insurance claims, Flight Delay Verification primarily focuses on:

- Actual departure and arrival times

- Delay duration relative to payout thresholds

It is also important that the data remains reliable and that we can trace it back in history. You can submit claims days or even weeks after the event.and historical consistency is critical for audits, dispute resolution, and regulatory review.

Individual Flight Checks vs. Insurer Needs

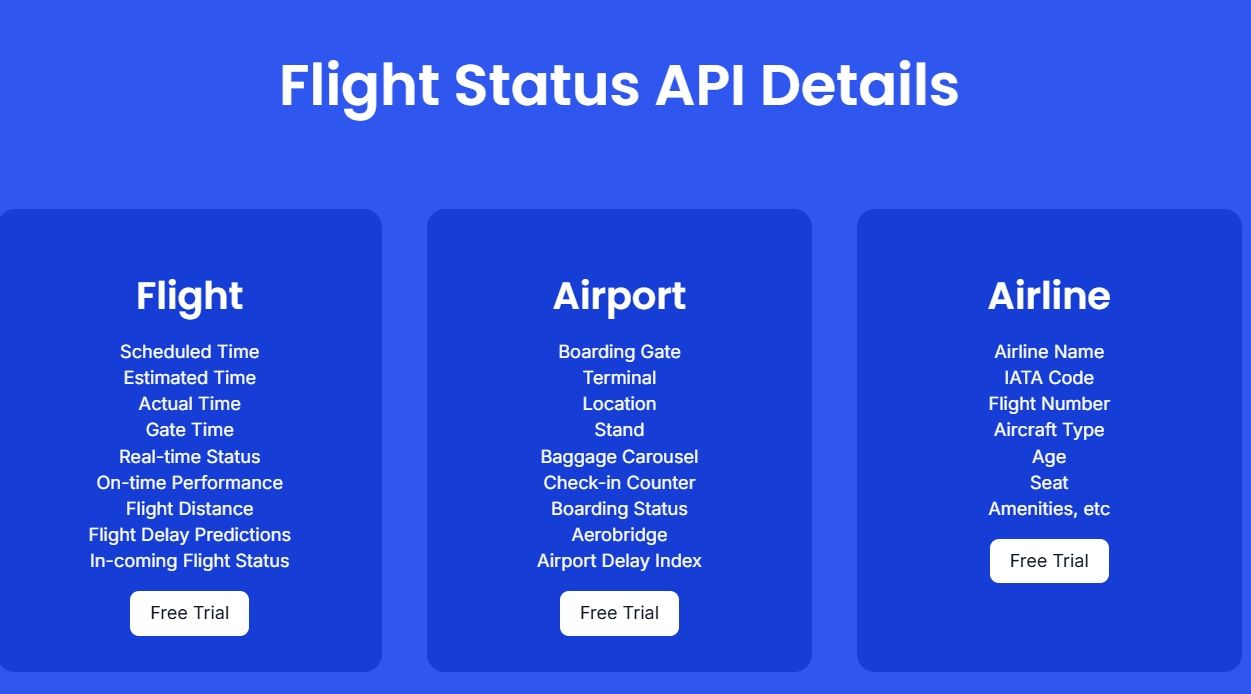

For individuals, checking a flight delay once is sufficient, and most consumer apps can provide this information. Insurers, however, require batch processing, stable, accurate, and compliant verification. API access enables integration into internal systems, supporting automated claims validation and streamlined workflows,and consistent, data-backed decision explanations at scale.

Data Requirements for Claims Verification

Flight data suitable for insurance verification should include:

- Global coverage: airlines and airports

- High coverage for both real-time and historical data

- Standardized format for system integration

- Traceable historical records for audit and review

- Stable, compliant, and continuously available

DataWorks tracks 97% of commercial flights around the world. This includes over 1,200 airlines and 10,000 airports. It helps with large-scale insurance claims processing.providing insurers with a reliable foundation for both automation and transparency in claims decisions.

Future Trends: Data Driving Insurance Efficiency

In the AI era, flight data will become a core asset for insurers:

- Automated claims processing: Reduces manual workload and speeds up claims

- Risk assessment: Optimizes pricing and underwriting strategies

- Product innovation: Designs new insurance products based on historical flight patterns

- Operational efficiency: Improves claims workflow and customer satisfaction

Flight Delay Verification is evolving from a support function to a core operational capability, fundamentally reshaping how insurers manage claims.

DataWorks Insights

Flight Delay Verification is not merely about checking a flight; it is a systematic capability encompassing batch processing, automated decision-making, explainability, and workflow optimization. Mastering this capability allows insurers to significantly reduce costs, improve efficiency, strengthen credibility with customers, and provide a robust data foundation for future product development.

DataWorks offers free flight data testing to help insurers evaluate system integration and data accuracy, lowering the barrier to try automated claims verification solutions.