How Real-Time Flight Data Helps Insurers Verify the “Date of Loss”

Da

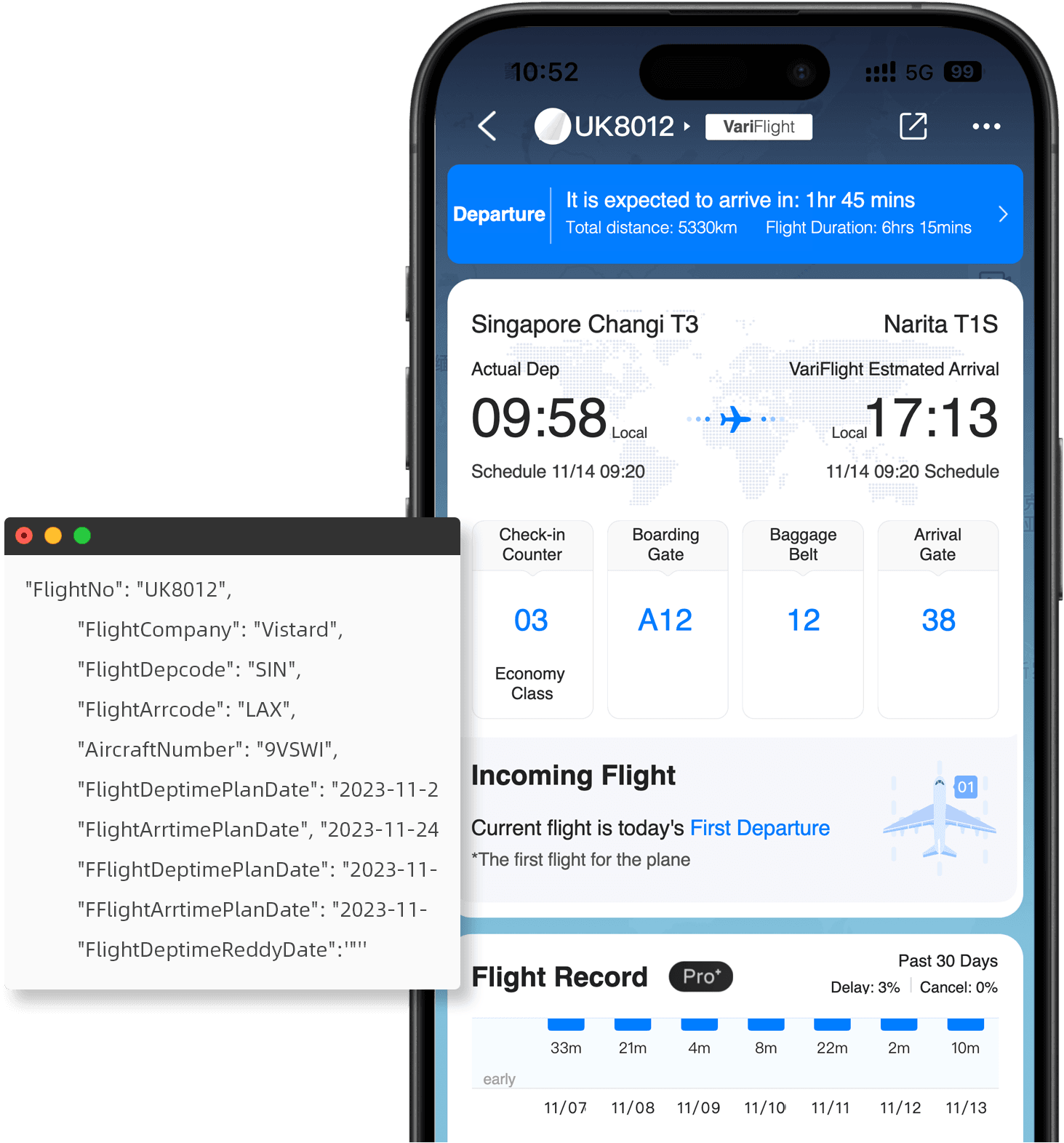

DataWorks offers real-time and historical flight data APIs for insurers. These APIs automatically verify the Date of Loss, enabling faster and more accurate claims processing. They cover over 1,200 airlines and 10,000 airports.

Introduction

The “Date of Loss” is a crucial detail in flight delay and cancellation insurance claims, as it determines when compensation begins. Traditionally, claimants provide this date, and insurers verify it manually using supporting documents.

With the rise of real-time and digital flight data, insurers can now verify the Date of Loss automatically. This approach increases accuracy, speeds up claims processing, and reduces operational costs.

Definition and Importance of the “Date of Loss”

The Date of Loss refers to the exact date and time when a covered flight event, such as a delay or cancellation, occurs. It is crucial because it directly impacts:

Claim eligibility – whether the event meets policy conditions. Compensation amount – how much the claimant is entitled to receive

Processing speed – how quickly the claim can be reviewed and settled

Accurate verification of the Date of Loss helps prevent delays, disputes, or errors in claims handling. It directly affects:

- Claim eligibility

- Compensation amount

- Processing timelines

Claims Processing and Typical Timelines

- Many online delay insurance products support simplified claims, completing verification and payout within 1–3 business days.

- Standard delay insurance requires claimants to submit claims within 7–15 days of receiving official proof of a flight delay or cancellation.

- Verification typically takes 5–10 business days; automated airline-partnered systems can settle claims instantly when integrated.

- Customer feedback shows that during peak periods, manual verification increases operational costs and negatively affects passenger experience.

Common Claim Errors

While there is no publicly available national error rate for flight delay or cancellation insurance claims, common issues include:

- Incomplete or incorrect user-submitted documentation

- Inconsistent or missing flight verification information

- Data integration delays that extend verification

- High proportion of manual review, which may lead to duplicate claims or incorrect denials

Application of Real-Time Flight Data

Real-time flight data can support insurers in verifying the Date of Loss by providing:

Coverage: Over 1,200 airlines and 10,000 airports, covering approximately 97% of commercial flights globally.

Monitoring capacity: ADS-B network tracks over 66,000 aircraft daily.

| API Type | Description | Access Method |

| Flight Status API | Provides real-time flight data | Direct API |

| Historical Flight Data API | Provides past flight information for post-event verification | Direct API |

| Data Category | Fields |

| Flight Times | Estimated, Actual Departure and Arrival Times |

| Airport Info | Gate Information, Boarding Status, Airport Delay Index |

| Flight Status | Real-time Flight Status, Delay Predictions, Incoming Flight Status |

| Airline Info | Airline Name, IATA Code, Flight Number |

| Aircraft & Seating | Aircraft Type, Age, Seat Information, Amenities |

| Airport Services | Stand, Baggage Carousel, Check-in Counter, Aerobridge |

Automated Verification Workflow

Using flight data APIs, insurers can create automated verification processes:

- Claimant submits flight number and date.

- System calls DataWorks API to retrieve flight delay or cancellation information.

- The system matches the flight event to generate the Date of Loss.

- If conditions are met (e.g., delay threshold exceeded), the system triggers the claim process or alerts for manual review.

Industry Applications and Potential Benefits

Applying real-time flight data in claims verification offers several benefits:

Efficiency: Reduces manual review and shortens claim processing times.

Accuracy: Ensures multi-leg and connecting flights are correctly verified, reducing errors.

Customer experience: Data-driven verification supports faster claims and increases trust.

DataWorks API and Free Trial

DataWorks provides both real-time and historical flight data APIs, which can be integrated directly into insurance claims systems:

Real-time flight data API: Offers flight status, delay predictions, boarding information, and more.

Historical flight data API: Supports post-event verification for claims.

Free trial: Insurers and partners can request access to test the API and explore how real-time data can automate claims verification.

Industry Trends and Conclusion

The flight delay and cancellation insurance sector is increasingly adopting data-driven and automated claim verification systems. Real-time flight data not only supports verification of the Date of Loss but can also be extended to risk modeling, dynamic pricing, and product optimization.

Integrating these data interfaces allows insurers to implement more efficient, accurate, and traceable claims processes, improving both operational performance and customer satisfaction.