Flight Data APIs for Insurers: Faster Claims, Better Risk Management

Da

Use VariFlight Flight Data APIs to automate claims, reduce costs, and improve risk management for insurers, reinsurers, and brokers.

This data-driven approach supports traditional products like flight delay insurance. It also helps create new property and casualty coverage solutions for the fast-changing travel industry.

Reliable Industry Data

In 2025, analysts project the global aviation insurance market will reach close to 900 million USD. Rising flight volumes, larger aircraft fleets, and the increasing number of travelers worldwide drive this steady growth. As the aviation industry grows, insurance companies must improve how they manage risk, handle claims, and ensure compliance.

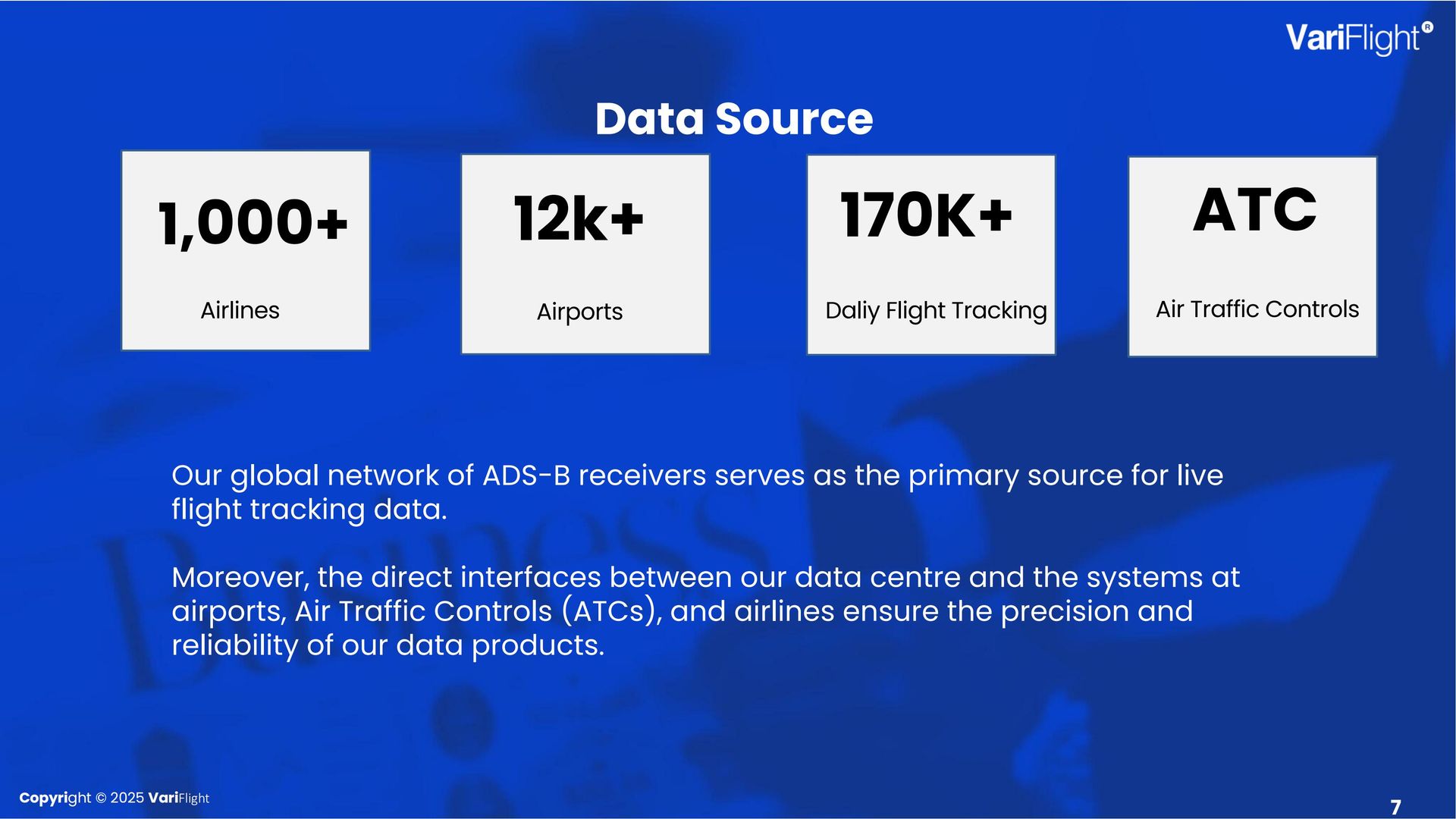

VariFlight processes around 1.5 billion raw flight data records each day. Its system tracks about 97 percent of global commercial flights, covering over 10,000 airports and 1,200 airlines.

The VariFlight Flight Data API handles over 16,000 system requests every second. It gives insurers reliable and frequent updates. This data helps insurance companies pay claims. It also improves underwriting models and enhances risk assessment practices.

Key Industry Roles

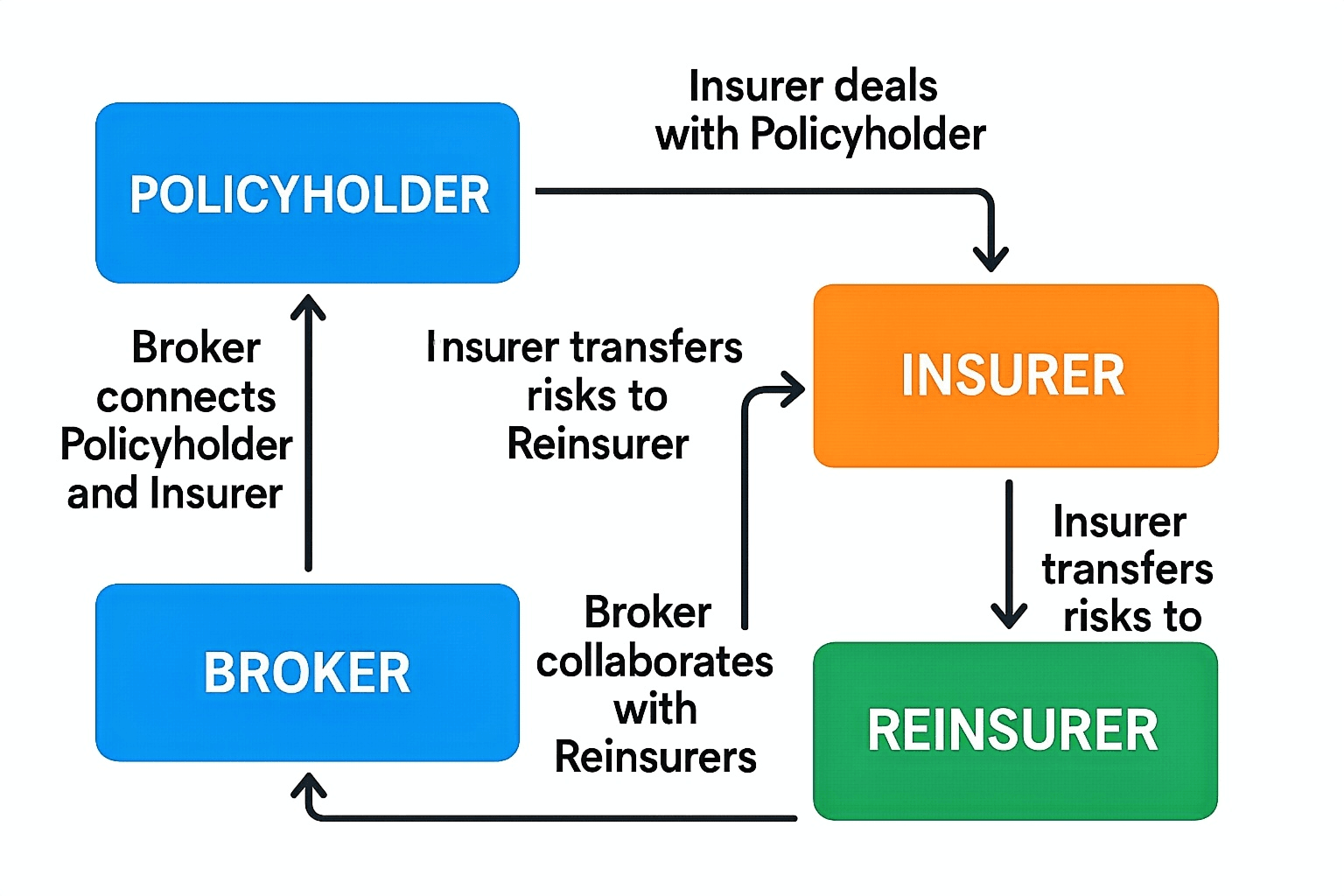

Insurance companies, re-insurers, and brokers each have unique responsibilities in the aviation insurance ecosystem:

Insurers handle aviation insurance products. They also manage property and casualty insurance lines. They decide how and when to pay claims.

Re-insurers: Help insurers by sharing responsibility for large-scale or catastrophic risks. They use data to support global risk coordination and disaster recovery planning.

Brokers: Serve as intermediaries between clients and insurers. They suggest personalized solutions. They help customers file insurance claims. They also explain how different types of claims work.

Application of Flight Data by Role

Insurers

Insurance companies rely on multiple data sources for managing risk. Insurers can improve their risk models.

They do this by combining several factors. These factors include flight status, chances of delays, types of aircraft, airport operations, and weather data. This helps them make more accurate property and casualty insurance products.

In the claims process, insurers can automate verification. When a customer files a claim for a flight delay or cancellation, the API checks real-time records. It looks at both scheduled and actual departure or arrival times.

This ensures that insurance claims work efficiently, with minimal manual intervention. As a result, the insurance company is able to pay claims faster and more accurately.

Re-insurers

Re-insurers depend on reliable global aviation data to conduct catastrophe modeling, evaluate regional risk exposure, and manage large-scale loss events. By using flight data and past safety reports, they can predict possible problems and create better plans to manage risk. The result is a stronger, more resilient aviation insurance ecosystem.

Brokers

Brokers use flight data to provide customized advice for both corporate and individual clients. By analyzing historical flight delays and cancellation trends, brokers can recommend products that match a customer’s travel patterns. Integrating APIs into mobile apps helps brokers give real-time alerts and updates on claims. This improves customer service and builds trust.

Key Benefits for the Insurance Industry

The integration of real-time aviation data into insurance operations provides several clear benefits:

Efficiency: Automation reduces manual verification and shortens the claims lifecycle from days to minutes. This helps insurers process large volumes of insurance claims with lower administrative costs.

Accurate Risk Control: Reliable flight data strengthens insurance risk management. Detecting fraudulent or invalid claims early can prevent financial losses.

Customizable Innovation: Multi-dimensional flight data helps insurers create personalized products for various customer groups. This includes frequent travelers and corporate clients who need property and casualty coverage.

Collaborative Capability: Insurers and reinsurers can share data insights to jointly manage catastrophic events, creating a more sustainable industry framework for managing risk.

Case Study: Flight Data API Enhancing Claims

A major insurance company offering flight delay insurance adopted the VariFlight Flight Data API to improve claims operations.

When insurance clients submit claims, the insurer’s system immediately retrieves information such as scheduled departure, actual arrival, delay duration, cancellations, or diversions. The system automatically compares this data to the policy terms. As a result, teams can now resolve claims that once required days of manual checks in minutes.

The insurer reported that they reduced claim handling costs by more than 80 percent. insurance clients experienced faster resolutions, improving satisfaction and loyalty. High data accuracy reduced false claims and human errors. This helped strengthen the company’s reputation for good insurance risk management.

This example highlights how aviation data supports property and casualty insurers in building efficient, transparent, and fraud-resistant workflows.

Free Data Usage Recommendations

VariFlight offers free access to basic APIs for flight status, airport information, and weather updates. Insurance companies, brokers, and developers can use these resources to test integration scenarios and validate new coverage ideas. Individuals and small businesses can apply for free trials. This helps them see how aviation data improves insurance claims and supports better product design.

Industry Value Summary

The VariFlight Flight Data API has become a critical enabler for insurance companies navigating the complexities of aviation insurance. By helping insurers automate claims, reduce operational costs, and improve risk management, the API supports innovation in both underwriting and property and casualty coverage.

Real-time aviation data helps insurers, reinsurers, and brokers work better and fairer in their processes. It helps insurance clients obtain payouts without delay. At the same time, insurers improve their skills to manage risk in a fast-changing market.

As the aviation sector grows, data-driven solutions like VariFlight will transform the handling of insurance claims. They will also affect how insurance companies pay claims. This will help the industry provide smarter and stronger protection for travelers around the world.

Free data trial and get more information: Here

Reference:

“VariFlight Cloud” Officially Launched to Empower the Aviation Tourism Ecosystem

SONAR 2023: New emerging risk insights - Swiss Re

https://www.globalgrowthinsights.com/zh/market-reports/aviation-reinsurance-market-102790