Case Study: How DataWorks Transformed Risk Control for Travel Insurers

bc

Learn how an insurer uses a historical flight data API to verify claims, cut processing time, and create new insurance products, boosting efficiency and trust.

Introduction

Travel insurance companies struggle with verifying flight delays, cancellations, and complex itineraries. Missing or inconsistent flight data can slow claims processing, raise error rates, and hurt customer satisfaction. To tackle this, a Southeast Asian insurer adopted the DataWorks Historical Flight Data API, leading to a data-driven, automated claims workflow.

This case study shows how using comprehensive aviation data improves efficiency, risk control, and product innovation in travel insurance.

Industry Background

Travel insurance inherently faces risks from flight delays, cancellations, missed connections, and unpredictable events. Global health crises, climate change, and regulatory shifts have intensified these risks.

Traditionally, claims processing depends on customer-submitted documents like boarding passes and delay notices. However, verifying these manually is labor-intensive and slow, often leading to mistakes. For insurers handling many claims, delayed verifications can increase complaints and costs.

As digital platforms grow, insurers look for ways to use aviation data to streamline claims workflows. Historical flight data offers verified, structured information that aids operational and strategic decisions.

Challenges Faced by the Insurer

Difficulty Verifying Flight History

Customers often submit incomplete or inconsistent information about delays or cancellations. Without reliable historical data, insurers must manually verify against multiple sources, delaying approvals.

High Manual Processing Costs

Traditionally, staff must cross-check flight records and documents. This process is resource-heavy and prone to errors.

Data Integration Across Multiple Sources

Flight data comes from airlines, airports, and ticketing platforms, each with different formats and update schedules. Reconciling this data manually complicates workflows and lowers efficiency.

Complex Multi-Leg and International Travel

Travel claims often involve multi-leg itineraries and international flights. Tracking delays across multiple segments adds complexity and risk.

Solution: DataWorks Historical Flight Data API

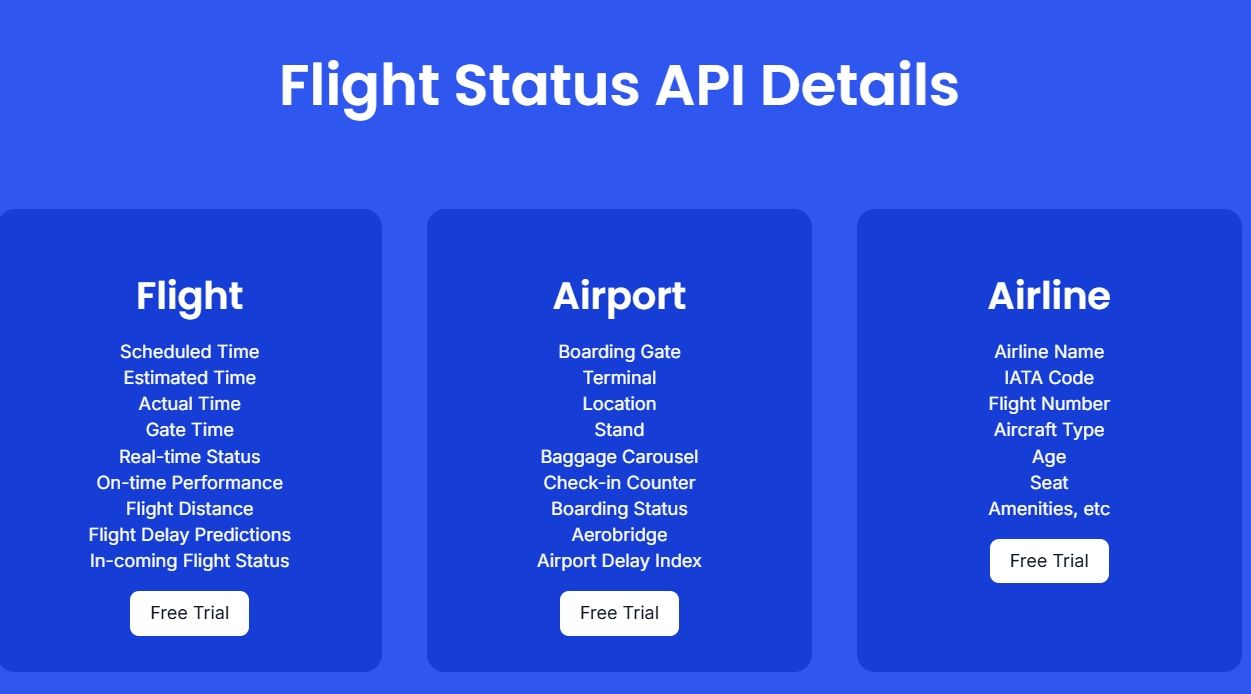

To overcome these challenges, the insurer implemented the DataWorks Historical Flight Data API for structured, high-coverage aviation data. This solution enabled:

Real-Time Claims Verification

When a claim is received, the system automatically queries the API for verified historical flight data. Delays and cancellations are checked against customer information instantly, removing the need for manual checks.

Automated Claims Processing

With structured data, the insurer's system can quickly determine claim eligibility based on policy terms. Automation speeds up approvals and ensures consistent decision-making.

Support for Multi-Leg and International Itineraries

The API covers many airlines and flight segments, allowing accurate verification for complex itineraries, including connecting flights.

Consistency, Traceability, and Auditability

Standardized historical flight data provides a reliable record for compliance and audits, boosting operational transparency and customer trust.

Data-Driven Risk Analysis

The insurer analyzes historical flight records to model risk exposure, forecast claims, and uncover patterns that guide underwriting and pricing strategies.

Implementation Process

Integration of Historical Data API

The insurer integrated the DataWorks Historical Flight Data API into their claims management system for automated data retrieval.

Workflow Automation

The system automatically matches claims with historical flight records. It flags discrepancies for review and processes compliant claims directly for payout.

Staff Training and Process Alignment.Teams actively used API outputs and received training to ensure smooth collaboration between automated systems and human decision-making.

Performance Monitoring

The team established KPIs to track claim processing times, accuracy, and customer satisfaction.

Ongoing monitoring allowed for continuous improvements and adjustments.

Outcomes

Improved Claims Efficiency

Automated verification cut processing times significantly. Claims that took days to resolve could now be settled in hours.

Enhanced Accuracy

Cross-checking with reliable historical flight data reduced errors, leading to fewer underpayments and overpayments.

Lower Operational Costs

Automating repetitive tasks decreased manual workload, allowing staff to focus on higher-value work.

Data-Driven Product Development

Historical flight data revealed delay patterns and customer behavior, informing the design of new insurance products tailored to travel risks.

Stronger Risk Management

By analyzing historical flight data, the insurer could better predict claims and allocate reserves, reducing financial risk.

Author Insights

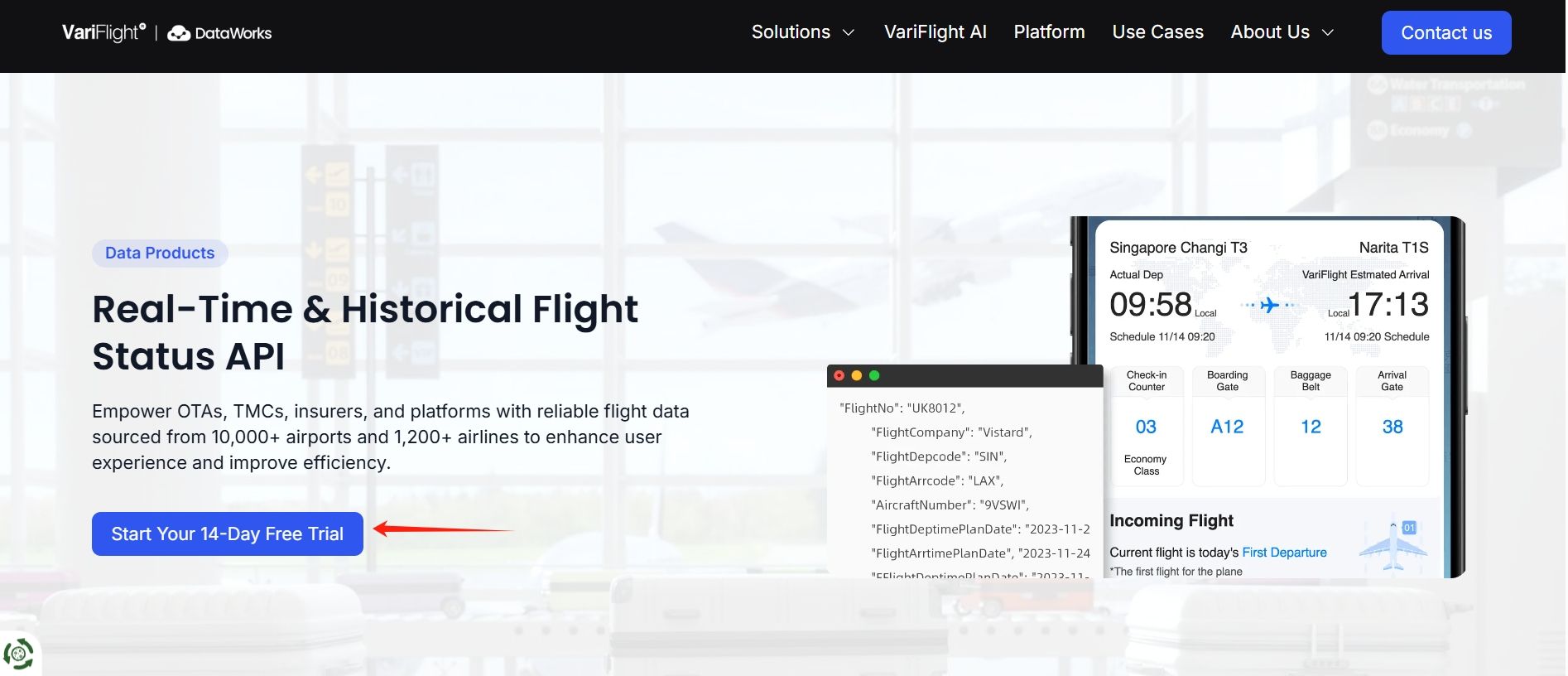

VariFlight’s aviation database covers 97% of commercial flights, over 10,000 airports, and 1,200+ airlines worldwide. DataWorks, a sub-brand of VariFlight, specializes in B2B aviation data solutions, with travel insurance as a key focus.

From our perspective: Historical flight data not only boosts claims verification but also lays the groundwork for innovative product design based on travel trends.

Insurers are increasingly adopting data-driven product logic like dynamic pricing and coverage customization.

DataWorks offers free trial access to its APIs, letting insurers assess benefits before full implementation.

Conclusion

The Southeast Asian insurer actively leveraged the DataWorks Historical Flight Data API to enhance risk control in travel insurance, improving claim verification and operational efficiency. Key takeaways include:

- Automating claims verification speeds up processing and boosts accuracy.

- Structured historical flight data aids risk modeling and strategic planning.

- Insights from flight data lead to new, data-driven insurance products.

- DataWorks provides scalable, high-coverage B2B aviation data solutions that enhance operational efficiency, customer satisfaction, and innovation.

Insurers integrate historical flight data into their workflows to improve transparency, increase reliability, and enhance responsiveness. This approach sets a new standard for data-driven risk management in the industry.

Free Trial : https://dataworks.variflight.com/about-us/contact