Flight Delay Claims: How Parametric Insurance Improves Travel Experience

bc

Parametric insurance is a new approach in travel insurance that improves travel insurance flight delay claims. By using accurate and timely flight data, insurers can verify and process these claims more efficiently.

This article explains problems with traditional travel insurance. It shows how flight data supports parametric insurance. It also shares real examples and answers common questions.

Article structure:

What is parametric insurance and how does it improve flight delay claims

Why traditional travel insurance struggles with flight delay compensation

How flight data enables parametric travel insurance to work efficiently

Real-world examples of parametric insurance improving flight delay claims

Common questions about parametric insurance and travel claims

How to use flight data APIs to build smarter insurance products

What Is Parametric Insurance and How Does It Improve Flight Delay Claims

VariFlight DataWorks is a global aviation data provider. We supply real-time and historical data on flight delays, cancellations, and airport performance to help insurers.. It does not require lengthy paperwork or subjective reviews.

In travel insurance, parametric products trigger payments when specific flight delays happen.

If a flight is delayed over 90 minutes, insurers check trusted flight data to confirm the delay. This helps process claims faster and more accurately.

Unlike traditional insurance, which requires customer-submitted documents and manual validation, parametric insurance relies on objective, real-time flight data. This improves fairness and speeds up the claims process, helping insurers reduce operational overhead.

VariFlight DataWorks is a global aviation data provider. We supply real-time and historical data on flight delays, cancellations, and airport performance to help insurers. Each disruption becomes a measurable, trackable data point to support better insurance product design and claims processing.

Why Traditional Travel Insurance Struggles with Flight Delay Compensation

Traditional flight delay insurance depends heavily on manual claims processing. Travelers often must submit boarding passes, delay confirmations, or photos to prove their claim. This creates a poor customer experience and high administrative costs for insurers.

Key pain points include:

Delay Definition Uncertainty: Different countries, airlines, and insurers define “delay” differently. Is it based on departure or arrival time? Is it 2 hours or 3?

High Fraud Risk: Travelers may exaggerate delays, requiring insurers to cross-check data manually.

Slow Processing: Claims often take days or weeks due to data collection and validation steps.

Disputes: Without a single source of truth, disagreements between customers and insurers are common.

These issues reduce trust and efficiency, problems parametric insurance models aim to address.

How Flight Data Enables Parametric Travel Insurance to Work Efficiently

For parametric flight delay insurance to function effectively, three elements are essential:

Clear Trigger Condition: For example, “Flight arrival delay exceeds 90 minutes.”

Trusted Data Source: Verified flight status data from APIs like VariFlight’s.

Efficient Claims Handling: Improved workflows enabled by precise data to assist human adjusters.

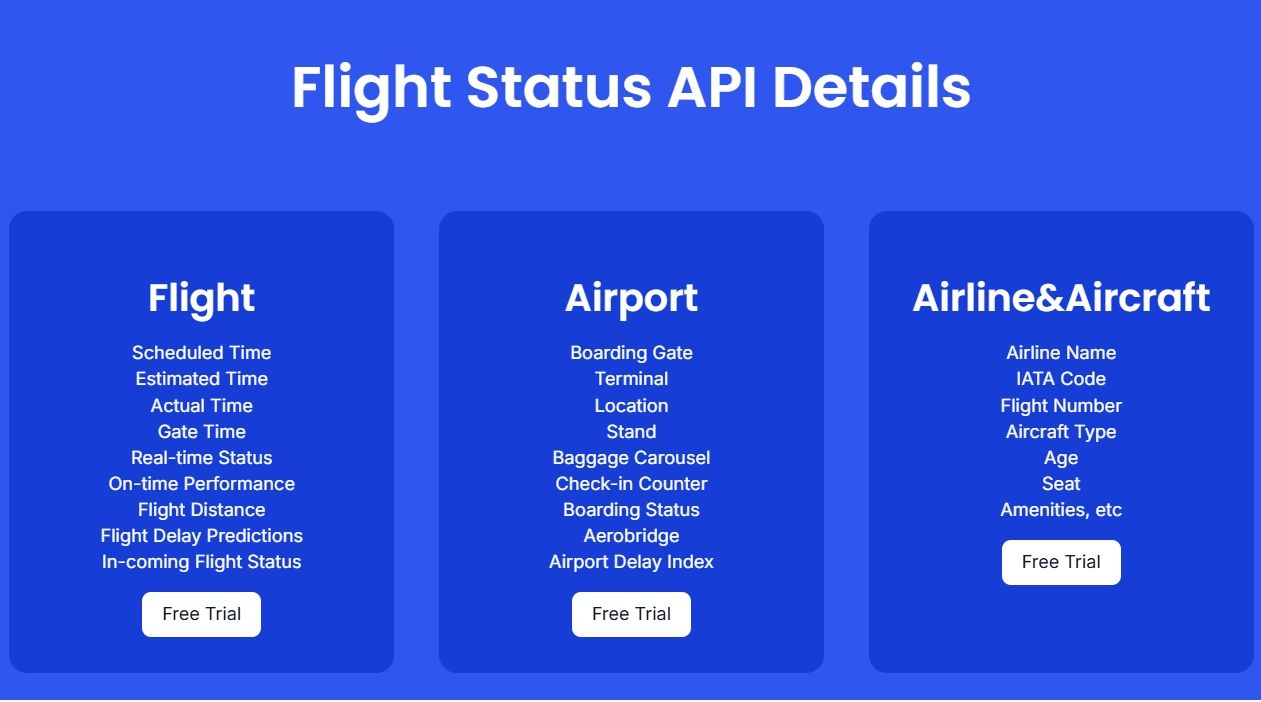

VariFlight DataWorks provides:

Real-Time Flight Status APIs: Instant verification of delays and cancellations.

Historical Delay Data: Supports risk modeling and premium pricing.

Airport and Route-Level Analytics: Helps insurers define smarter parametric thresholds.

These tools transform abstract risk into measurable outcomes, enabling insurers to write objective rules, improve claim accuracy, and reduce fraud and delays in claim handling.

Real-World Examples of Parametric Insurance for Flight Delay Claims

Case 1: Asian Insurer Improves Delay Claims Efficiency

An Asia-Pacific insurer used VariFlight’s flight status API to launch a parametric delay insurance product. When customers’ flights were delayed over 2 hours, insurers used our real-time data to quickly verify claims. This way of using data helped cut claim processing time from 5 days to less than 30 minutes. It greatly improved customer satisfaction and work efficiency.

Case 2: Risk-Based Pricing Using Historical Delay Data

A European digital insurer accessed VariFlight’s historical data to model delay likelihoods by route and airline. They built dynamic pricing models charging lower premiums for reliable routes and higher ones for riskier flights. This approach increased profit by 12%.

Case 3: OTA Adds Parametric Insurance as Booking Add-On

A major online travel agency integrated parametric flight delay insurance into its booking system. Using real-time delay feeds from VariFlight, the insurance product became a popular upsell, especially among business travelers. Customers praised the transparency and speed of claim verification supported by accurate data.

Common Questions About Parametric Insurance and Travel Claims

Q: What is parametric travel insurance?

A: It’s a kind of insurance that pays when certain events happen, like a flight delay over 90 minutes. Customers don’t need to send lots of papers or wait a long time.

Q: How does parametric insurance differ from traditional flight delay insurance?

A: Traditional insurance often requires travelers to provide proof of delay. Parametric insurance relies on third-party real-time flight data to confirm events and assist claims verification.

Q: Can parametric insurance reduce fraud?

A: Yes. Because claims use trusted data from VariFlight’s APIs, there is less chance of cheating or lying.

Q: Is parametric insurance widely accepted globally?

A: Adoption is growing, especially in Europe and Asia. Insurers can move from slow, reactive claims to fast, data-driven service by using real-time flight data and clear rules.

How to Use Flight Data APIs to Build Smarter Insurance Products

If you’re an insurer, insurtech company, or travel provider, follow these steps to implement parametric insurance:

Define Trigger Conditions: For example, “Delay exceeds 90 minutes.” Use historical data to test frequency.

Integrate Real-Time Flight Data APIs: Access up-to-date information on delays, arrivals, and cancellations.

Optimize Claims Workflows: Use accurate data to support adjusters in faster claim verification and decision-making.

Monitor and Refine: Use analytics dashboards to track performance and adjust products to maximize profit.

VariFlight offers easy-to-integrate data services with reliable uptime, global coverage, and enterprise-grade service level agreements.

Get Started with Parametric Flight Delay Insurance Powered by Real-Time Data

Parametric insurance is more than a trend—it’s the future of travel protection.

VariFlight DataWorks helps you:

Launch parametric flight delay insurance products quickly

Reduce claim processing friction and errors

Price policies are flexibly based on real-world data

Ready to enhance your travel insurance offerings?

👉 Contact VariFlight DataWorks for a free consultation or API trial.

References

OECD: Parametric Insurance Explained

EU EC261 Flight Delay Compensation Rules

What Is Parametric Travel Insurance – InsurTech Insights

IATA - Passenger Rights and Claims

Insurance Information Institute (III) - Travel Insurance Basics

FlightAware - Flight Delay Statistics and Analysis

Parametric Insurance Association (PIA)